There are many pricing methodologies, both formal and informal, but any price management system is incomplete at best, and margin-eroding at worst, without the ability to identify and capture all actual costs and connect them to their associated revenues.

Powerful Pricing built up from the Bill of Materials

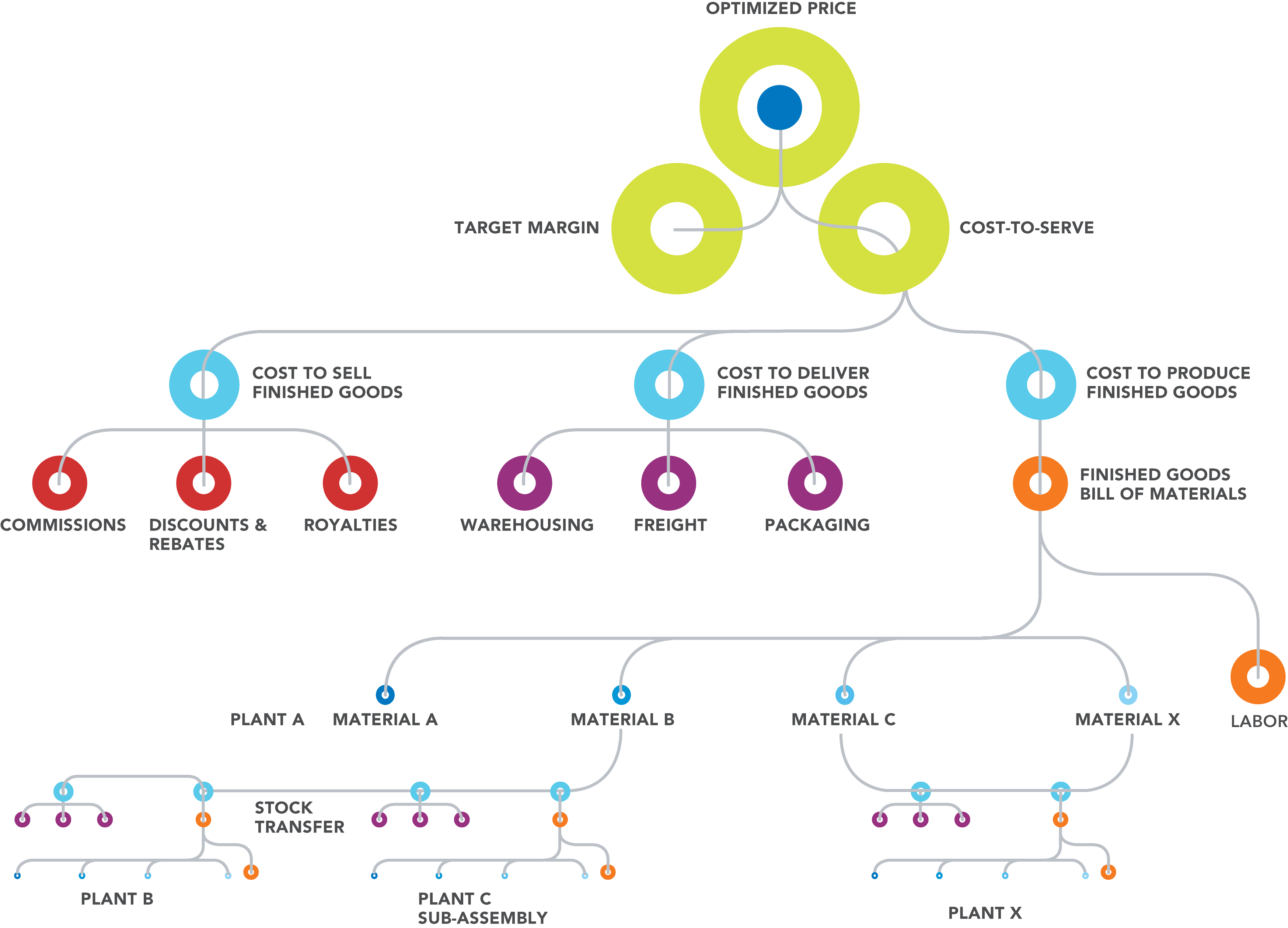

pVelocity’s unique ability to link all associated costs, from all relevant business systems and sources, to a complete, detailed Bill of Materials (BOM) provides all users with the most comprehensive cost picture possible. While other systems focus on standard costs or calculated cost methodologies, pVelocity’s method is simple: find all the actual costs every product incurs from upstream suppliers to downstream partners or customers, and link them in real time to product revenues.

pVelocity provides visibility on costs otherwise hidden within standard costing approaches. This insight into true costs provides users with the confidence to price with complete, real-time accuracy – either to be at their most competitive or to identify those opportunities they should walk away from.

In addition to price setting, these linked actual costs can also provide the insight needed for decision-making on:

- Strategic moves like market entries or withdrawals

-

Tactical choices like product introductions or which customers to serve

What’s the best price I can offer and still win the deal – and maintain margin targets?

Ultimately, this is the question everyone wants answered. But it can only be truly addressed when all dimensions of the problem are analyzed. pVelocity draws data from all relevant business systems, including ERP, CRM, BI, and even spreadsheets, to provide a complete, customized real-time picture of actual costs. Data from these sources is presented in a user-friendly, spreadsheet-like interface and organized into a “sandbox” where analysts, product & pricing managers, and even sales personnel can view costs, determine the optimal price, and meet margin targets for any product or contract at any given time.

Segment & Simulate for Pricing Precision and Margin Optimization

With pVelocity, that data is used to segment products or customers to increasing levels of granularity, revealing outliers or consistently low/high performers.Then, pVelocity’s powerful “what-if” simulation engine allows price changes to be modeled, instantly predicting the impact across the operation:

- What customers are likely to accept a price increase or take advantage of a price decrease; how will volumes be impacted?

- What new market or customer opportunities are there for the taking?

- What is the margin impact, in the future, of price changes across segments, markets, or facilities?

Pricing & “The Big Picture”

Sometimes pricing is not so much about costs as it is about the customer relationship. Too much focus on the cost of an individual product could jeopardize the overall contribution of an important customer. With pVelocity, customers can be analyzed for their total contribution margin across the full range of products, assets, or facilities, quantifying the margin impact pricing decisions may have. With this unique pVelocity feature, decision-makers can make the moves necessary to shift resources, gain efficiencies, make substitutions, or accept aggressive margins on an individual deal in order to better serve top margin-producing customers.

Discover sources of margin leakage

- Which customers are receiving unearned or out-of-proportion volume discounts?

- Which customers have the highest cost-to-serve because of special packaging or delivery demands?

- Which sales reps or regions have consistently lower pricing?

Pricing Management in an Environment of Fluctuating Costs

It is especially challenging to analyze and set prices when commodity or component prices are rapidly rising and falling. pVelocity’s ability to capture actual costs in real time, right down to the BOM, means that prices simulated or set are reflective of the most current, and therefore most accurate, cost conditions available. The difference between these actual costs and static, standard costs could mean the difference between a margin-destroying deal and a profitable, sustainable customer relationship.