Can you Simulate how changes across the Supply Chain affect Assets,Customers and Products?

Traditional business systems like ERP and SCM can be effective at using standard costs in backwards-looking performance monitoring, but they present a challenge when modeling and predicting effects of cost changes across linked elements like upstream and downstream partners, assets and facilities, and products and customers. Often contained in siloed systems and one-off spreadsheets, actual costs are critical to the ability to perform simulations that are credible,reliable, and actionable.

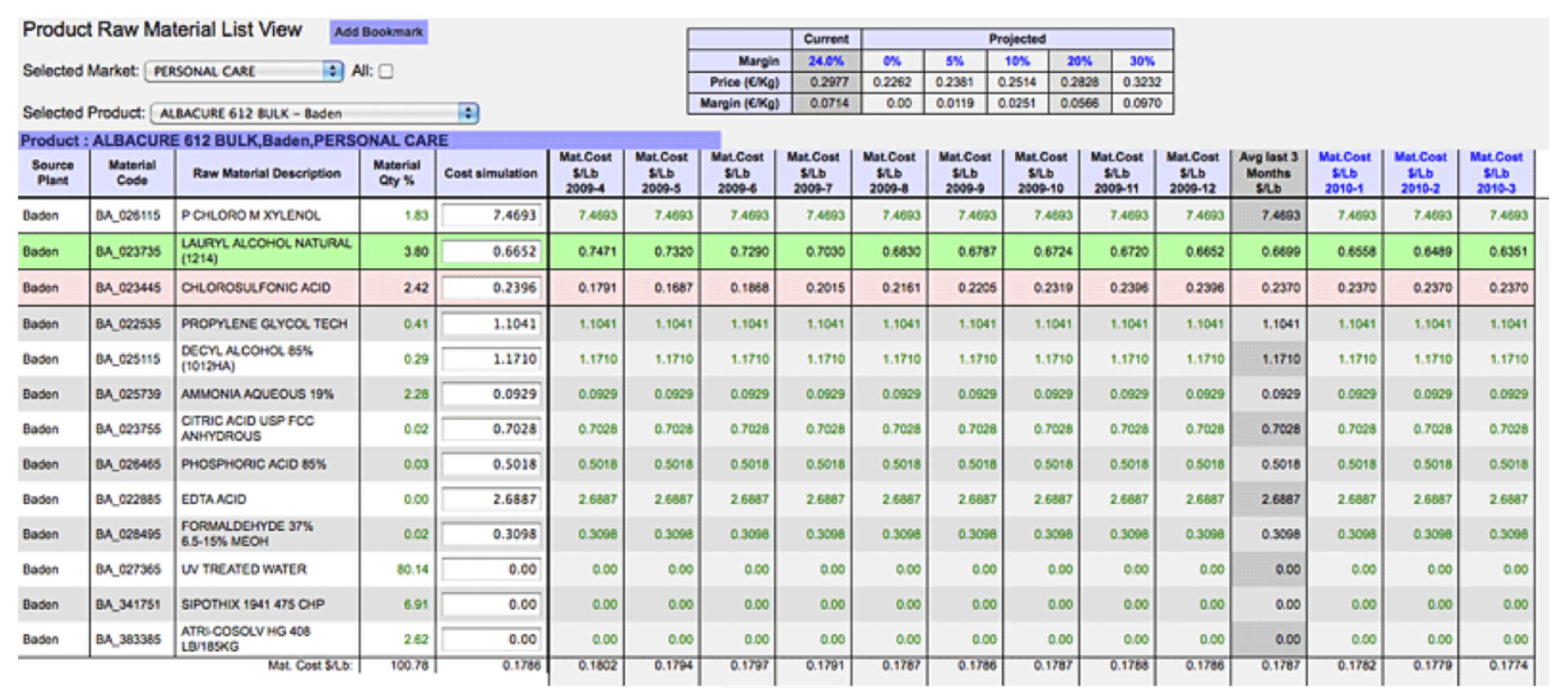

Providing an Accurate basis for Current Product Costing and Pricing

pVelocity’s Profit & Cost Simulation software is the only solution that consolidates actual cost data from enterprise systems and sources to ensure that you are working with the most up-to-date costs that affect materials or components, assets, facilities, freight, energy, packaging and more. pVelocity uses this data to provide:

- Powerful cost visibility inside and outside the enterprise

- Instant “what-if” simulations to support realtime scenario modeling and decisions

Get instant access to your production recipes by product or customer

Use pVelocity Simulation to Analyze the Effects of Changing Your Supply Chain

The pVelocity Cost Simulator provides a “sandbox” based on actual cost data to assess and model different scenarios like:

- Re-allocation of production resources from lower margin products to higher performing lines

- Material substitutions, cost adjustments, or volume increases

- The adjustment of yield of any number of production orders by reducing scrap or increasing equipment effectiveness

Model and Forecast Outcomes with Confidence

- First, use actual cost data to categorize and segment affected products, assets, and facilities by contribution margin, volume, and revenue

- Then, drill deep to determine products and assets affected by material or component shortages or changes

- Follow with simulations to model the risk and impact of price increases on sales volume, downstream fulfillment, and operational efficiency