What does pVelocity Provide that Enterprise Systems Lack?

![]() Decision-makers must be able to predict the margin effect of changing variables and, to fully visualize those effects, simulations are required that rely on linking the margin relationships between products, customers, assets, materials, and suppliers. Having a detailed and transparent view of these connections is the foundation to better decisions, improved performance and margin growth.

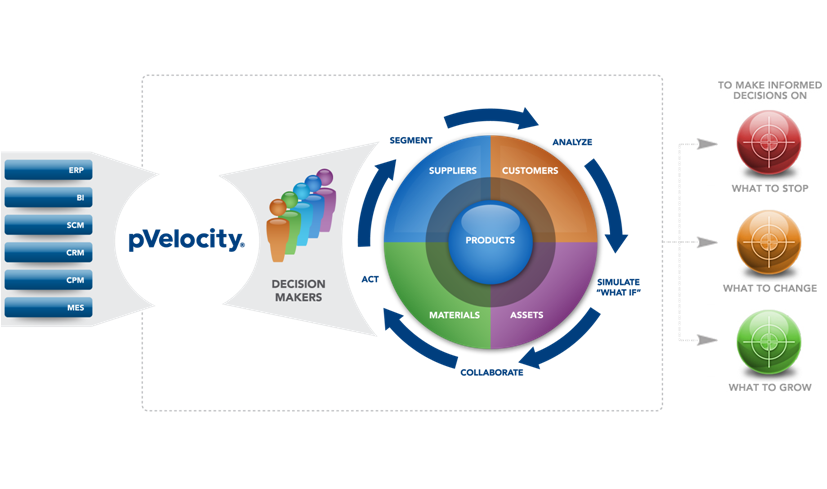

Decision-makers must be able to predict the margin effect of changing variables and, to fully visualize those effects, simulations are required that rely on linking the margin relationships between products, customers, assets, materials, and suppliers. Having a detailed and transparent view of these connections is the foundation to better decisions, improved performance and margin growth.

The current operational environment

It would be inaccurate to describe multi-million dollar implementations like ERP as narrow in focus – they are designed to do many things very well. The reality is, however, they simply can’t do everything equally as effectively, and that fact has spawned other multi-million dollar variations on the theme, with SCM, CRM, CPM and others filling in the gaps left by ERP.

It would be inaccurate to describe multi-million dollar implementations like ERP as narrow in focus – they are designed to do many things very well. The reality is, however, they simply can’t do everything equally as effectively, and that fact has spawned other multi-million dollar variations on the theme, with SCM, CRM, CPM and others filling in the gaps left by ERP.

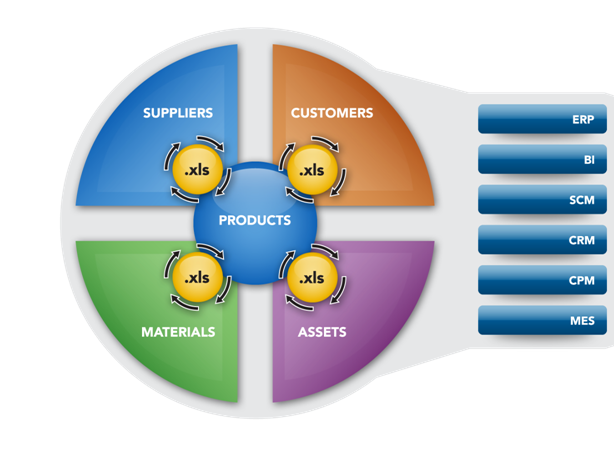

While all of these systems provide an excellent individual view, and, if taken together, may paint a relatively complete picture, most enterprises today are still struggling with the lack of ability to say, with confidence, which products, customers, or markets contribute most to overall margin performance. Even with multi-million dollar implementations to look at the business from every angle, these companies still turn to the lowly spreadsheet – a near-literal blank sheet of paper – to get a clearer picture of margins across the enterprise.

Why is that?

Most systems are made to capture performance on a specific measure. However, the definition of performance differs from activity to activity. What constitutes performance in the plant? Maximizing throughput. In Supply Chain? Optimized routings or sequencing. In Sales? Increased revenue.

The common goal for all of these, of course, should be profit. You can have the most efficient production assets anywhere, but they could be at full capacity churning out money losers. You can be gaining market share, but without a really clear idea of what it’s costing you to gain that share. And sales could be achieving higher revenue on high volume, low margin products.

The reality is that, despite all the systems at the disposal of the enterprise to collect and analyze various methods of functional performance, none of them really attempt to bring together all the critical aspects of profitability– products, customers, assets, materials, and suppliers – to create a real-time, granular-level snapshot of margins. Because of the investment made in these enterprise-class systems, this data is being collected. It’s just not being connected.

Without this vital linking, mission-critical decisions will be made on “siloed” information – a one-dimensional view of performance based on the perspective of the functional area being analyzed. Couple that with disparate systems that may or may not be talking to each other in increasingly fractured organizational structures , and then factor in functional roles that, in most cases, do not have a clear view into other areas, and you have a recipe for decision-making that is incomplete at best, and dead-wrong at worst.

Of course, this isn’t really new, and accounting practices have devised standard costs or activity-based costing as methods to provide a common basis for determining profitability. What has changed, however, is the velocity at which input costs are changing. With raw material or component costs fluctuating wildly, standard costs quickly become inaccurate, and day-to-day decision making can be severely impacted by data that is significantly outdated.

pVelocity

pVelocity is a solution that is purpose-built to rapidly connect actual cost data associated with products, customers, assets, materials, and suppliers, in real-time, from all relevant business systems and tools. With this data, each operational role relevant to profit decisions gains visibility into every angle of the profit picture, allowing them to segment and analyze margin performance – right down to the bill of materials - for every product made by the company, for every asset it uses to manufacture products, and for every customer that buys those products.

Rather than replace powerful business systems, pVelocity leverages the investments made by enterprises in these tools to create the most up-to-date, accurate picture of profitability previously hidden across systems or roles. Then, pVelocity uses this data to enable business users to not only perform backwards-looking analysis, but also to create powerful simulations, answering the question “what would happen if…” any number of cost and profit scenarios were to become reality.

With this analysis, proactive executives in Product and Pricing Management, Sales & Marketing, Supply Chain, Production and Corporate functions can undertake collaborations and take action on immediate, corrective, and strategic decisions to improve overall corporate profit performance and to optimize processes for long-term competitiveness.